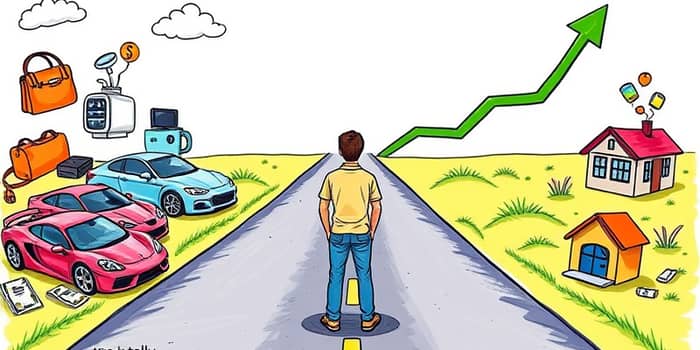

As your income increases, it’s natural to want more comforts, but unchecked spending can quietly erode financial stability. Recognizing and resisting lifestyle creep is essential to ensure your newfound earnings power lasting gains rather than fleeting luxuries.

Lifestyle creep, also known as lifestyle inflation, happens when your standard of living rises alongside income, turning once-occasional treats into everyday essentials. This gradual shift often goes unnoticed until you find your savings stagnant despite a bigger paycheck.

Unlike necessary cost-of-living adjustments driven by inflation or geographic changes, lifestyle creep stems from personal choices and social influences. It commonly occurs after salary raises, promotions, or debt payoffs—and can be exacerbated by comparing yourself to peers or projecting a desired social status.

When lifestyle inflation infiltrates your budget, it threatens long-term goals and adds stress. Even modest upscaling—like weekly dining out or upgrading to premium services—can compound into serious setbacks.

Key risks include:

Identifying lifestyle creep early allows you to course-correct before habits become entrenched. Watch for these indicators:

Several mental biases make lifestyle creep insidious:

The hedonic treadmill describes how we quickly adapt to higher consumption, making past luxuries feel ordinary and prompting further upgrades. Similarly, the concept of “goalpost moves” reflects how we shift our expectations upward as soon as we meet previous targets.

Social comparison also intensifies the urge to keep pace with friends or colleagues. Meanwhile, mental accounting errors lead us to treat bonuses or windfalls as free money, rather than opportunities to strengthen our financial foundation.

Preventing lifestyle inflation requires intentional planning and disciplined execution. Incorporate these habits into your financial routine:

By implementing a “pay yourself first” philosophy, you ensure that savings and investments grow before discretionary spending increases. This simple shift can safeguard long-term ambitions like homeownership, entrepreneurship, or early retirement.

Consider Sarah, a graphic designer whose annual salary jumped by 20%. Initially, she celebrated by upgrading her streaming plan and ordering takeout twice a week. Over months, these small changes drained her emergency fund and left her uneasy despite the pay raise.

Realizing her savings rate had fallen, she paused and reallocated 15% of her paycheck to a high-yield savings account. Within three months, Sarah rebuilt her cushion and redirected her focus toward a travel fund—enjoying treats occasionally but never at the expense of her financial health.

As Morgan Housel observes, “The hardest financial skill is getting the goalpost to stop moving.” When tempted to upgrade with each pay bump, pause and ask: “Does this change move me closer to my long-term vision?”

Similarly, financial planners remind us that every decision to increase spending should be weighed against its potential to unsettle your plan. If a purchase derails budgeting or forces you to cut corners elsewhere, it’s worth reconsidering.

Lifestyle creep may be a gradual, even stealthy, force, but you hold the power to control it. By staying vigilant, establishing clear priorities, and automating your savings, you can allow your wealth to flourish without sacrificing peace of mind.

Remember, true progress isn’t measured by the extravagance of your purchases but by the freedom and confidence you build through prudent choices.

References