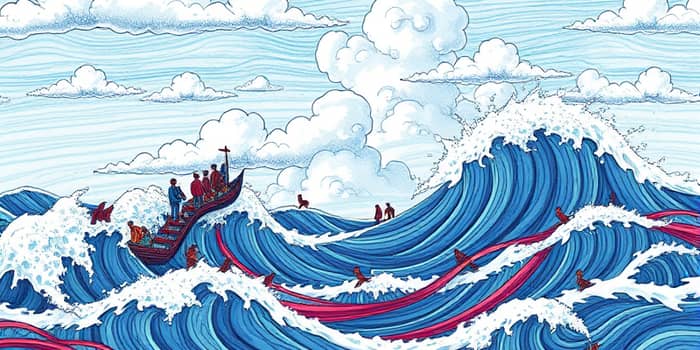

Markets around the world move through patterns of highs and lows, often leaving investors questioning their next steps. By understanding these rhythms and adopting clear strategies, you can ride the waves rather than be swamped by them.

Throughout this guide, you will discover definitions, real examples, and practical tools to navigate each market phase with confidence and clarity.

At its core, a market cycle is a set of recurring periods of economic expansion and contraction that shape asset prices over time. These dynamics influence everything from stocks and bonds to commodities and real estate.

Recognizing cycle patterns helps investors anticipate potential turning points, manage risk, and align portfolios to prevailing conditions.

Financial analysts commonly break market cycles into four phases, each characterized by unique investor behaviors and sentiment shifts.

While the table outlines typical durations and behaviors, remember that no cycle follows a fixed schedule. External factors such as policy changes, geopolitical events, or technological disruptions can accelerate or extend any phase.

Market cycles dovetail with the broader business cycle, consisting of expansion, peak, contraction, and trough. During economic expansion, rising GDP and low unemployment often coincide with a mark-up phase in markets.

Conversely, recessionary pressures—negative growth and rising joblessness—align with mark-down periods. Identifying where the economy stands provides deeper insight into likely market behavior.

To pinpoint cycle shifts, rely on a diverse mix of leading and lagging indicators. Leading signals, like yield-curve inversions or volume spikes, hint at upcoming changes.

Lagging metrics—unemployment rates, inflation statistics, and corporate earnings—confirm the strength or weakness of a trend after it unfolds.

Technical patterns such as trendlines, moving averages, and volatility indices complement fundamental analysis, creating a combination of indicators and analysis that guides timely decisions.

Adapting your portfolio to each cycle stage can enhance returns and reduce risk. Below are core approaches for every phase:

Emotional traps often derail even seasoned investors. Awareness of cognitive biases is vital to staying disciplined.

By establishing clear rules for entries, exits, and position sizing, you can avoid emotional decision-making traps and stick to your plan.

Historical cycles reinforce the importance of preparedness. The 2009–2020 U.S. bull market spanned over 11 years, offering immense gains for patient investors. By contrast, the 2008–2009 bear market saw the S&P 500 plunge roughly 57%.

Sector rotation strategies employed by major firms, using composite scoring models, highlight how different industries lead or lag during each phase. Recognizing these patterns can uncover relative value opportunities.

No methodology is infallible. Accurate timing of market turns is notoriously difficult, even for professionals. Each cycle carries unique drivers—policy shifts, technological innovations, or global events—that can upend expectations.

Robust risk management—through diversification, stop-loss orders, and periodic rebalancing—serves as your safeguard against unexpected shocks. Maintaining flexibility and a willingness to adapt is as crucial as any indicator.

Market cycles are inevitable, but surprise need not be. By grasping the four phases, monitoring key indicators, and deploying phase-appropriate strategies, you position yourself to benefit from changing conditions.

Embrace a disciplined approach, stay attuned to economic signals, and continually refine your playbook. In doing so, you transform market cycles from daunting challenges into powerful opportunities for growth.

References