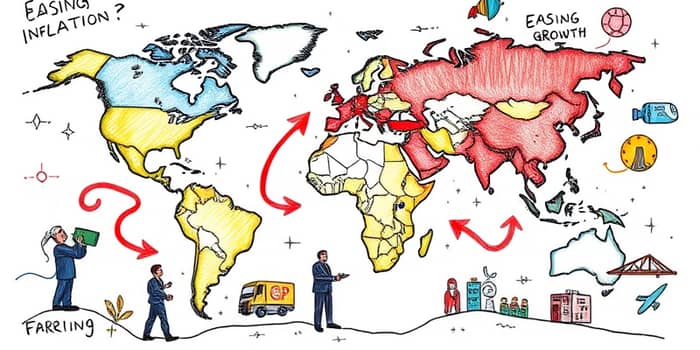

As the global economy navigates the aftermath of pandemic disruptions and geopolitical shocks, there is a palpable shift in price dynamics and activity levels worldwide. While headline inflation has begun to recede from its 2022 peak, the pace of recovery and growth remains anything but uniform. This uneven terrain offers both challenges and opportunities, demanding creative adaptation and collective resolve.

By 2025, forecasts suggest that global inflation is easing to around 4.0 percent, down from nearly nine percent in 2022. Advanced economies, including the United States, have seen inflation moderate to levels not observed since early 2021, with key drivers such as food and energy prices receding.

Yet beneath these aggregate figures, persistent regional growth disparities remain stark. While East Asia thrives on robust consumption and stable Chinese demand, many emerging markets still grapple with inflation rates hovering in double digits. Africa’s rebound is tempered by conflict, debt distress, and climate vulnerabilities, and Europe confronts demographic headwinds that keep productivity gains modest.

Several factors have contributed to the recent moderation in inflation. Falling energy prices have been a principal force, with US energy inflation declining by 3.7 percent as supply chains stabilized and commodity markets settled. Meanwhile, global trade is projected to expand by 3.2 percent in 2025, bolstering supply and easing price pressures for many manufactured goods.

However, sluggish productivity and weak investment continue to weigh on potential output and cost structures. Core inflation, which excludes the volatile segments of food and energy, remains persistent in several regions, signaling that deeper structural forces are at play. Tariff adjustments and lingering supply chain frictions may also exert upward pressure on consumer prices, though their impact could unfold gradually as firms adjust.

Across households and enterprises, the interplay of moderating prices and uneven growth shapes daily decisions. For families, lower energy and food inflation provide relief—but high rental and essential service costs still strain budgets in many cities. Businesses benefit from reduced input price volatility, yet they confront lingering demand uncertainties and financing challenges as central banks maintain cautious stances.

To thrive in this context, entities of all sizes can consider the following adaptive measures:

Government officials and institutional leaders play a pivotal role in shaping the trajectory of recovery and inclusion. Addressing high debt burdens and financing constraints in developing regions is critical to unlocking investment in infrastructure, education, and public services. Strengthening trade and investment frameworks can also spur competition and innovation.

Key policy priorities include:

Despite the challenges, this period of moderating inflation and uneven growth presents a unique opening for innovation and cooperation. Regions that invest in clean energy transitions, digital infrastructure, and workforce development are likely to see more robust and inclusive expansions.

By embracing renewed global cooperation and dialogue, countries can navigate transnational risks—ranging from commodity price swings to climate shocks—more effectively. Cross-border research, technology sharing, and joint investment vehicles can drive collective progress, ensuring no nation is left behind.

Businesses and communities that focus on sustainability, adaptability, and resilience will be best positioned to capture the upside of this evolving landscape. From renewable energy ventures in South Asia to advanced manufacturing clusters in Europe, the seeds of future growth are already being sown.

As headline inflation curves bend downward, the uneven distribution of growth forces us to rethink strategies at every level. Households must balance short-term relief with long-term planning; firms need agility and foresight; and policymakers must deliver inclusive and sustainable growth through sound, data-driven reforms.

Ultimately, the journey toward a more stable and equitable global economy rests on collaboration, innovation, and steadfast commitment to shared goals. By understanding the nuances of this new era and acting decisively, we can transform current headwinds into catalysts for a brighter, more resilient future.

References