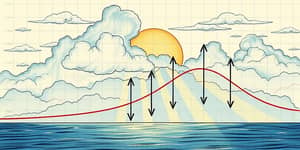

In an increasingly volatile market environment, investors are searching for ways to preserve capital and maintain peace of mind. Hedging, at its core, serves as insurance against market downturns, providing a structured method to guard portfolios from sudden losses. While it cannot eliminate risk entirely, a well-designed hedge can act as a buffer, offering protection without surrendering all upside potential.

In this article, we will explore the principles of hedging, key strategies ranging from options to diversification, real-world performance data, and practical considerations for implementation. Whether you are a seasoned institutional manager or an individual investor, these insights will help you craft a resilient portfolio that can weather turbulent markets.

By embracing a disciplined hedging plan, investors can maintain focus on their long-term objectives rather than reacting emotionally to short-term volatility. Effective protection strategies transform uncertainty into opportunity, allowing portfolios to navigate storms with greater composure and resilience.

Markets can move unpredictably, driven by economic shocks, geopolitical events, or sudden shifts in investor sentiment. Without a protective layer, portfolios may suffer severe drawdowns that take years to recover. The purpose of hedging is not to amplify gains, but rather to reduce potential losses from market downturns in a cost-effective way.

Every hedge comes with a cost—whether it is an option premium, transaction fees, or the opportunity cost of holding defensive assets. Yet, this expense is a small price when compared to the emotional and financial toll of a large unplanned loss. By carefully balancing cost and protection, investors can pursue long-term objectives with greater confidence.

Hedging strategies can be broadly classified into three categories. Each approach has unique benefits and trade-offs, and in practice, many investors use a combination to optimize results.

Below, we examine each category in detail, complete with examples and numerical illustrations.

Derivatives-Based Strategies rely on financial contracts whose value derives from an underlying asset. Popular methods include buying protective puts, selling covered calls, or trading futures. For instance, if you own 100 shares of a stock trading at $50, purchasing a $48 strike put for $2 per share caps your maximum loss at ($50–$48 + $2)×100 = $400, even if the stock plunges to zero. This provides full downside protection while preserving unlimited upside potential minus the cost.

Alternatively, selling covered calls generates income that can partially offset declines. Imagine holding 100 shares at $150 and writing a call with a $150 strike for $3 in premium. That $300 collected reduces your breakeven level to $147, offering a modest cushion but capping gains above the strike price.

Futures contracts allow an investor to lock in a sale price on a market index or commodity. Selling S&P 500 futures against an equity portfolio effectively hedges against a broad downturn, although it introduces margin requirements and potential losses if markets rally. Advanced techniques such as delta hedging—constantly adjusting option positions to remain neutral to price shifts—and pairs trading—simultaneously long and short positions in correlated assets—require sophisticated risk management but can deliver precise exposure control.

ETFs offer a transparent, liquid, and low-cost way to hedge broad exposures. Inverse ETFs deliver returns opposite to their benchmark, making them an accessible tool for retail and institutional investors alike.

During the first half of 2022, the S&P 500 fell by 23%. By allocating a 10% hedge to ProShares Short S&P 500 ETF (SH), portfolios saw returns improve by approximately 4%–7% while volatility declined by 5%–9%. Similarly, bond investors using a 20% position in ProShares Short 20+ Year Treasury ETF (TBF) reduced losses from 25.9% to 17.3% and cut volatility from 18% to 11.9%.

While effective, inverse and leveraged ETFs carry risks of tracking errors and daily rebalancing effects, making them better suited for short- to medium-term hedging rather than long-term anchoring.

Spreading capital across uncorrelated asset classes is the simplest form of hedging. By holding equities, bonds, commodities, and real estate, negative performance in one area may be offset by stability or gains in another. This long-term smoothing of returns can be especially valuable in unpredictable markets.

Safe-haven assets such as U.S. Treasuries and gold often retain value—or even appreciate—during periods of high volatility. ETFs like iShares 20+ Year Treasury Bond ETF (TLT) provide direct exposure to government debt, offering a low-cost way to mitigate equity risk without using complex derivatives.

Of course, diversification cannot eliminate systemic risk or guarantee positive returns, but it remains a cornerstone of prudent portfolio construction.

Implementing a hedging program requires careful calculation of costs and benefits. Suppose you wish to hedge a $1 million U.S. equity portfolio over three months using at-the-money SPX put options when the S&P 500 sits at 5,425 and VIX is 12.50. Two contracts (each covering $100,000) might cost approximately $20,000—about 2% of the portfolio value. This premium is a known expense, offering a clear cap on potential losses.

Real-world practice often favors partial hedging in the 10%–30% range of portfolio value, striking a balance between protection and cost drag. Fully hedged positions may underperform during sustained rallies, whereas too little hedging leaves portfolios vulnerable to steep drawdowns.

Historical market events underline the value of well-calibrated hedges. In early 2020, rapid pandemic-driven declines erased more than 30% of equity value within weeks. Portfolios with a modest 20% hedge via protective puts or inverse instruments saw drawdowns cut to 15%–20%, enabling faster recovery when markets rebounded.

During the 2008 financial crisis, investors who combined bond allocation with option overlays experienced declines of 10%–15%, compared to 30% losses for all-equity portfolios. These outcomes demonstrate how partial hedging balances cost and protection across market cycles.

Hedging is not a one-size-fits-all solution; it requires alignment with your investment goals, risk tolerance, and time horizon. Below are complementary strategies to enhance your toolkit:

Consistent monitoring and adjustment are essential. Market conditions evolve, and hedges that once offered optimal protection may become costly or ineffective. Regularly review your positions, adjust hedge ratios, and stay informed about volatility trends.

Remember, the most successful hedges are those that are reviewed regularly, adapted to changing conditions, and executed with precision. A proactive mindset will ensure your defense remains as dynamic as the markets you face.

References