As 2025 unfolds, bond yields have become a barometer of investor sentiment, reflecting a blend of hope and hesitation. After years of historically low rates, the resurgence of higher yields has stirred both excitement and prudence among market participants. The rise in long-term Treasury yields, combined with a steeper yield curve, signals a market that is tentatively embracing the prospect of decent returns, yet remains wary of economic headwinds.

Against this backdrop, portfolios are being recalibrated to navigate a landscape marked by shifting policy decisions, unpredictable macroeconomic indicators, and global interdependencies. In particular, the intersection of cautious optimism tempered by volatility underscores a nuanced approach, as investors weigh potential gains against evolving risks.

Throughout 2025, bond markets have been defined by sharp price movements and rapid yield adjustments. The ICE BofA MOVE Index, a key measure of Treasury market turbulence, spiked in April, highlighting the market’s sensitivity to trade policy announcements and fiscal debates.

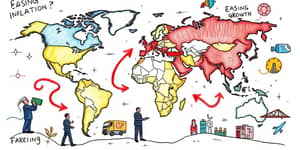

These volatile swings in the bond market are not isolated incidents but part of a broader trend influenced by shifting U.S. tariff strategies, soaring government debt levels, and uneven global growth patterns. Such factors have contributed to both short-term trading opportunities and longer-term strategic recalibrations.

In 2025, the yield on the 30-year U.S. Treasury bond climbed above 5 percent, reaching highest levels since 2007. This milestone reflects concerns over an expanding federal deficit, potential tax-and-spending legislation, and persistent expectations of robust economic growth.

Moreover, the upward movement in yields is a global phenomenon. Major economies in Europe and Asia have experienced parallel increases, driven by similar fiscal pressures and monetary policy shifts. Analysts project that U.S. Treasury rates will settle in the 4 percent to 5 percent range for the year, offering attractive yields compared to historical averages.

The Federal Reserve’s stance remains central to yield trajectories. After three rate cuts in late 2024, the Fed has maintained a steady interest rate level through early 2025.

Looking ahead, markets expect the Fed to hold off on additional cuts until at least September, unless inflation slows markedly or job creation weakens unexpectedly. The combination of trend toward lower borrowing costs and persistent uncertainty creates both opportunities and hazards for fixed income investors.

High-yield bonds, often referred to as junk bonds, continue to attract attention for their potential to deliver enhanced returns amid stable credit conditions. Corporate balance sheets, on average, remain solid, and default rates are forecasted to stay well below historical norms.

These features illustrate attractive risk-return profiles for investors seeking income in a higher-rate environment.

Despite intermittent bouts of volatility, surveys and market positioning indicate an uptick in investor confidence. The expectation of a soft landing—where economic growth slows without tipping into recession—has fed a sense of strategic component in diversified portfolios.

However, caution is warranted. Duration risk, which measures sensitivity to interest rate changes, remains a critical consideration. While long-duration bonds can lock in higher yields, they also amplify price fluctuations in response to unexpected policy shifts or economic surprises.

For many investors, the current yield environment represents a rare convergence of opportunity and risk. Portfolio managers are exploring a balanced allocation across maturities, credit qualities, and geographic markets to optimize returns and mitigate upside surprises. Emphasis is being placed on agile strategies that can adapt as data on inflation and employment trends evolve.

Ultimately, bond yields in 2025 offer a window into investor psychology, blending opportunity and caution in balance. As market conditions evolve, the ability to adjust swiftly and thoughtfully will determine success in the fixed income arena. By remaining vigilant and flexible, investors can navigate the complex interplay of volatility, policy, and economic growth, harnessing yields to meet both income objectives and risk management goals.

With disciplined risk management and diversified allocations, investors can seize favorable yields while guarding against downside shocks.

References